Corrections and clarifications regarding the Government’s fiscal surpluses and Singapore’s Reserves

False and misleading statements in Facebook posts and articles published

by Yeoh Lam Keong and The Independent Singapore

min read

Published on 18 Nov 2022

- On 7 November 2022, Mr Yeoh Lam Keong (“Yeoh”) published two Facebook posts stating that “... we have a $30 bn structural fiscal surplus that we have not even begun to publicly delineate clear spending big plans for.” The Independent Singapore (“TISG”) reproduced Yeoh’s statement in two of its articles dated 9 November 2022 and 12 November 2022 respectively.

- Yeoh’s statement claims that there are $30 billion in structural fiscal surpluses that are available to the Government for spending. This is untrue.

- Over the last two decades (excluding FY2020, which had a significant fiscal deficit due to COVID-19 expenditures), the Government recorded on average a fiscal balance of $2.2 billion per annum. It is therefore untrue that the Government has “a $30 bn structural fiscal surplus” that is available for spending yearly.

- The Constitution defines clearly the fiscal rules for the Government. Any public spending beyond these fiscal rules means that we will be using more from the Past Reserves, and leaving behind less for the next generation.

- Furthermore, the Government is not in a position to freely or unilaterally decide to spend any part of the Past Reserves. Any drawing of the Past Reserves is subject to the President’s concurrence.

- The Minister for Finance has instructed the Protection from Online Falsehoods and Manipulation Act (POFMA) Office to issue Correction Directions to Yeoh and TISG. The Correction Directions require the recipients to insert, amongst others, a notice against the original posts / articles, with a link to the Government’s clarification.

Additional Clarifications

- In his Facebook posts, Yeoh also expressed his view that “our reserves” would grow very strongly (i.e, at “the rate of $50-$100 bn a year”) for the next 5 to 10 years because of balance of payment (“BOP”) surpluses, leading to higher Net Investment Returns Contribution (“NIRC”) derived from the reserves, over the medium to longer term. This view was also reproduced by TISG in its article on 9 November 2022.

- The Constitution defines the “Reserves” as the total assets less total liabilities (i.e. net assets) of the Government and other entities specified in the Fifth Schedule to the Constitution, such as the Monetary Authority of Singapore (“ MAS”).1 The assets include the Official Foreign Reserves (“OFR”) held by MAS.

- It is misleading to suggest that BOP surpluses will lead to our Reserves growing very strongly for the next 5 to 10 years.

- First, while BOP surpluses correspond to an increase in OFR assets, this increase in OFR assets does not result in an equivalent increase in the Reserves. This is because the increase in OFR assets may be matched by increases in MAS’ liabilities. For instance, when MAS purchases foreign assets whilst implementing monetary policy, the increase in OFR is accompanied by an increase in MAS’ liabilities, such as MAS Bills.

- Second, it is speculative to suggest that MAS’ OFR will continue to grow at the same rate as historical BOP trends. While MAS has had a steady accumulation of OFR in recent years, this took place during a period of unprecedented monetary easing globally. The same monetary conditions are now turning with global central banks tightening monetary policy aggressively. Trends in OFR accumulation will change against this evolving global monetary backdrop.

- Yeoh thinks that strong “reserves” growth and “higher NIRC revenues” will give us a “fair chance” of addressing our spending needs. But this is misguided.

- The returns from the investment of our Reserves are more likely to slow over time, given the structural challenges in the world, including rising geopolitical tensions, climate change, and ageing populations.

- In the past 5 years, the NIRC provided an average annual revenue stream of about 3.5% of GDP. MOF has already explained that we expect the NIRC to keep pace broadly with economic growth over the medium to longer term.2 That means that as government spending continues to increase as a share of GDP, we will need to rely on other revenue sources to close the funding gap.

1 See MOF’s FAQ for more information: https://www.mof.gov.sg/policies/reserves/what-comprises-the-reserves-and-who-manages-them

2 See Budget 2022 Round Up Speech: https://www.mof.gov.sg/singapore-budget/budget-2022

RELATED ARTICLES

Most Popular

Changing your residential address

Renting out your HDB flat: A homeowner's guide

What You Need to Know: The GST Rate from 1 January 2024

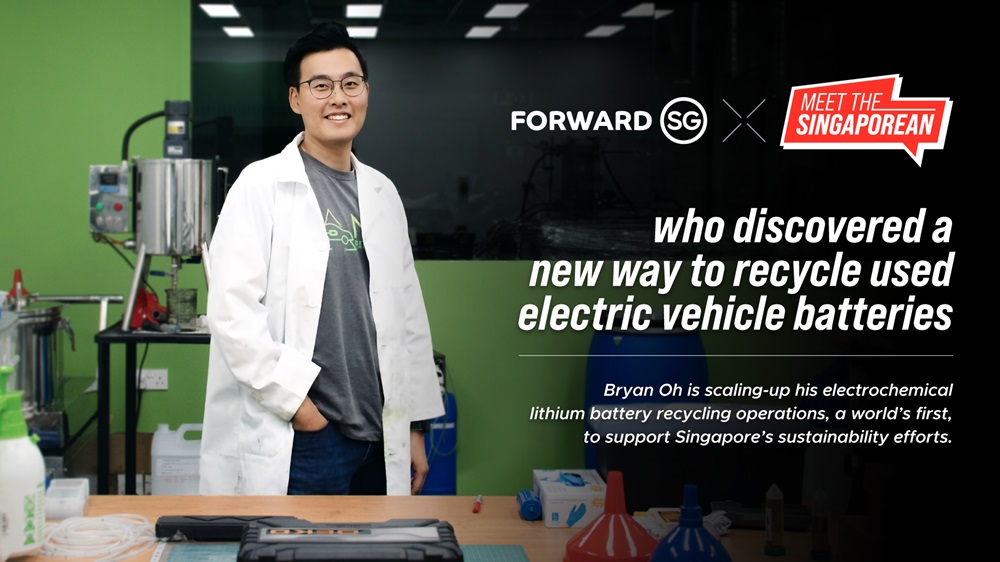

Meet the Singaporean - Christopher Leow

Is it true that I have to pay GST on items purchased overseas?

Corrections regarding falsehood on building flats for multi-generational living

Corrections regarding falsehoods in Mr Leong Mun Wai’s social media posts (12 Feb 2024) and republished by The Online Citizen and Gutzy Asia

Singapore: Is it really the most expensive place to live?

Property Tax on Residential Property

Clarifications regarding Security Progressive Wage Model

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .

![[Updated] Promoting regular self-testing](/images/default-source/media/gov/images/articles/thumnails/mtfarticle_240921a.jpeg?Status=Master&sfvrsn=4b2280f8_0;mw=1000&hash=AEBFFAB60CB60B4BFD8B18367921A5EE)