Keeping the costs of healthcare low is a challenge for countries around the world. According to the World Health Organization, government spending in healthcare has grown faster than the rest of the economy. This is in part due to rising economic growth and technological advances.

Singapore’s population is ageing rapidly. While preventive measures such as staying healthy and eating well can help to stave off chronic illnesses in the long term, the Government has put in place measures to keep healthcare costs affordable for all Singaporeans.

For all Singaporeans

The Government ensures that all Singaporeans are well-protected against ill health and large medical costs by setting up four lines of defence before and in the event that you fall ill and require treatment.

1. Subsidies

The first line of defence is subsidies. Hospitalisation, outpatient care and long-term care are heavily subsidised.

You can get subsidies of up to 80% for your hospitalisation bill at public hospitals (B2/C wards). Regardless of the ward you choose, the quality of care is the same.

2. Insurance

The second line of defence is insurance, which protects Singaporeans against unexpected healthcare costs.

MediShield Life provides all Singaporeans with health insurance coverage for life, regardless of age, health condition and pre-existing conditions. It helps to pay for large hospitalisation bills and selected costly outpatient treatments, such as dialysis and chemotherapy.

CareShield Life, which will be rolled out from mid-2020, provides cash payouts for individuals with severe disability, for life.

3. MediSave

The third line of defence is MediSave, where the Government helps all Singaporeans save up for a rainy day.

Set aside monthly from a part of your salary, your MediSave savings can help pay for surgery, hospitalisation, health screenings, medical insurance, severe disability (from mid-2020) and more – for you and your immediate family members.

4. Safety Nets

The fourth line of defence is our safety nets.

MediFund is a safety net for Singaporean patients who have financial difficulties with their remaining bills, after Government subsidies and drawing on other means of payment including MediShield Life, MediSave and cash.

From 2020, ElderFund will help the severely disabled but who have financial difficulties.

What happens if you have a chronic condition, e.g. high blood pressure or diabetes, and need regular treatment?

Good news, the Community Health Assist Scheme, or CHAS, now covers all Singaporeans with selected chronic conditions, regardless of income!

Treatment and medication costs at polyclinics and public Specialist Outpatient Clinics (SOCs) are also heavily subsidised, through means-testing and based on age, by up to 75% at the polyclinics and up to 70% at the public SOCs. Pioneer Generation and Merdeka Generation seniors also receive additional special subsidies.

For families that need further help

On top of the subsidies and defences that all Singaporeans get, lower-income families get additional help from the Government.

Lower- to-middle-income families get up to 50% subsidies on their MediShield Life premiums. Those who still cannot afford their premiums can apply for Additional Premium Support.

From 1 Nov 2019, Singaporeans with selected chronic conditions, regardless of their income, will benefit from be eligible for CHAS.

The new CHAS Green card provides up to $160 in annual subsidies for selected chronic conditions.

CHAS Blue and Orange cardholders also get higher subsidies at CHAS GPs. CHAS Orange cardholders will now get subsidies for common illnesses of up to $10 per visit, as well as up to $80 subsidy per visit (up from $75) for complex chronic illnesses, capped at $320 per year (up from $300). CHAS Blue cardholders get up to $125 subsidy per visit (up from $120) for complex chronic illnesses, capped at $500 per year (up from $480).

If you are severely disabled, aged 30 and above and need financial help, you can apply for ElderFund from 2020 to receive monthly cash payouts.

If you still have difficulty affording your medical bills, MediFund will provide discretionary financial assistance.

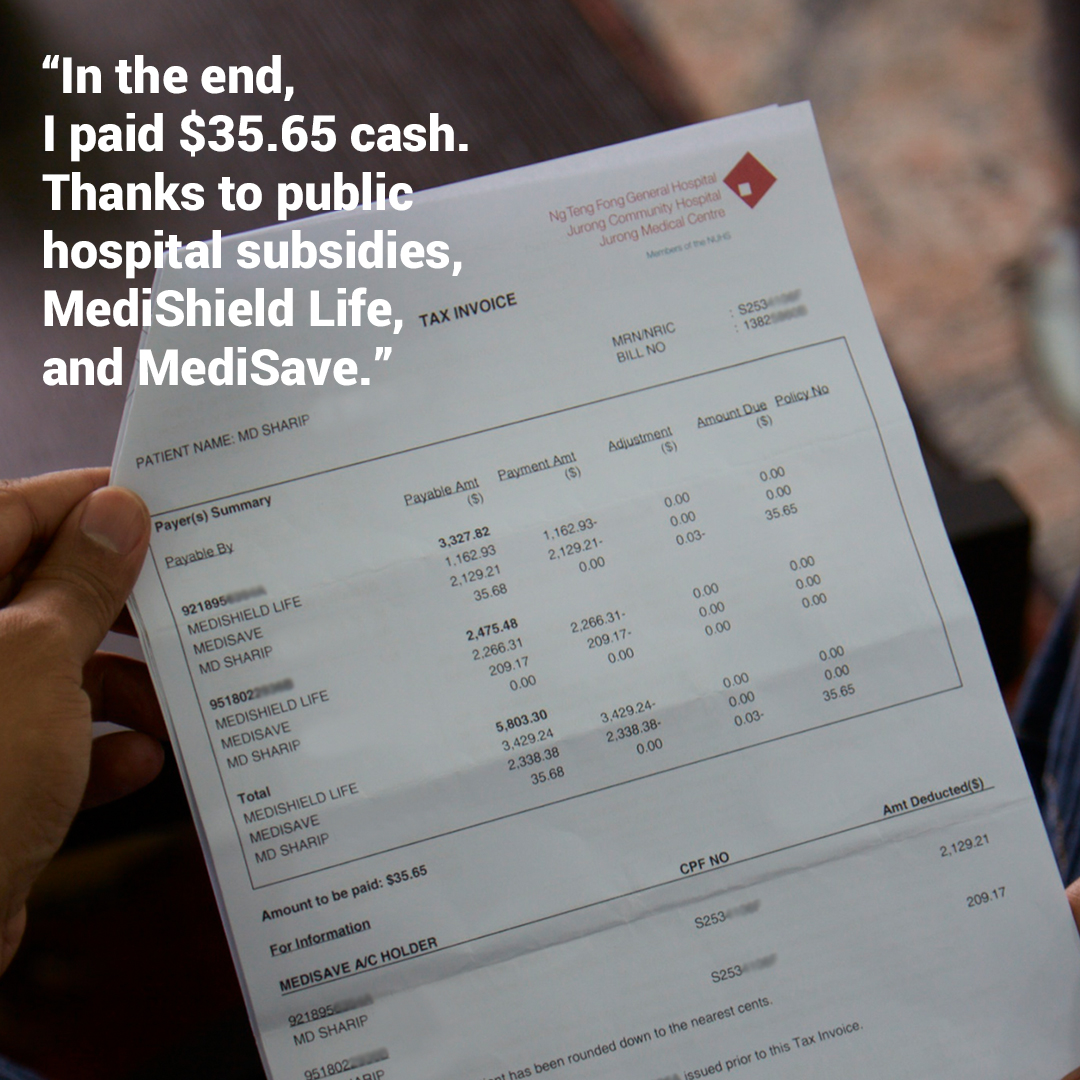

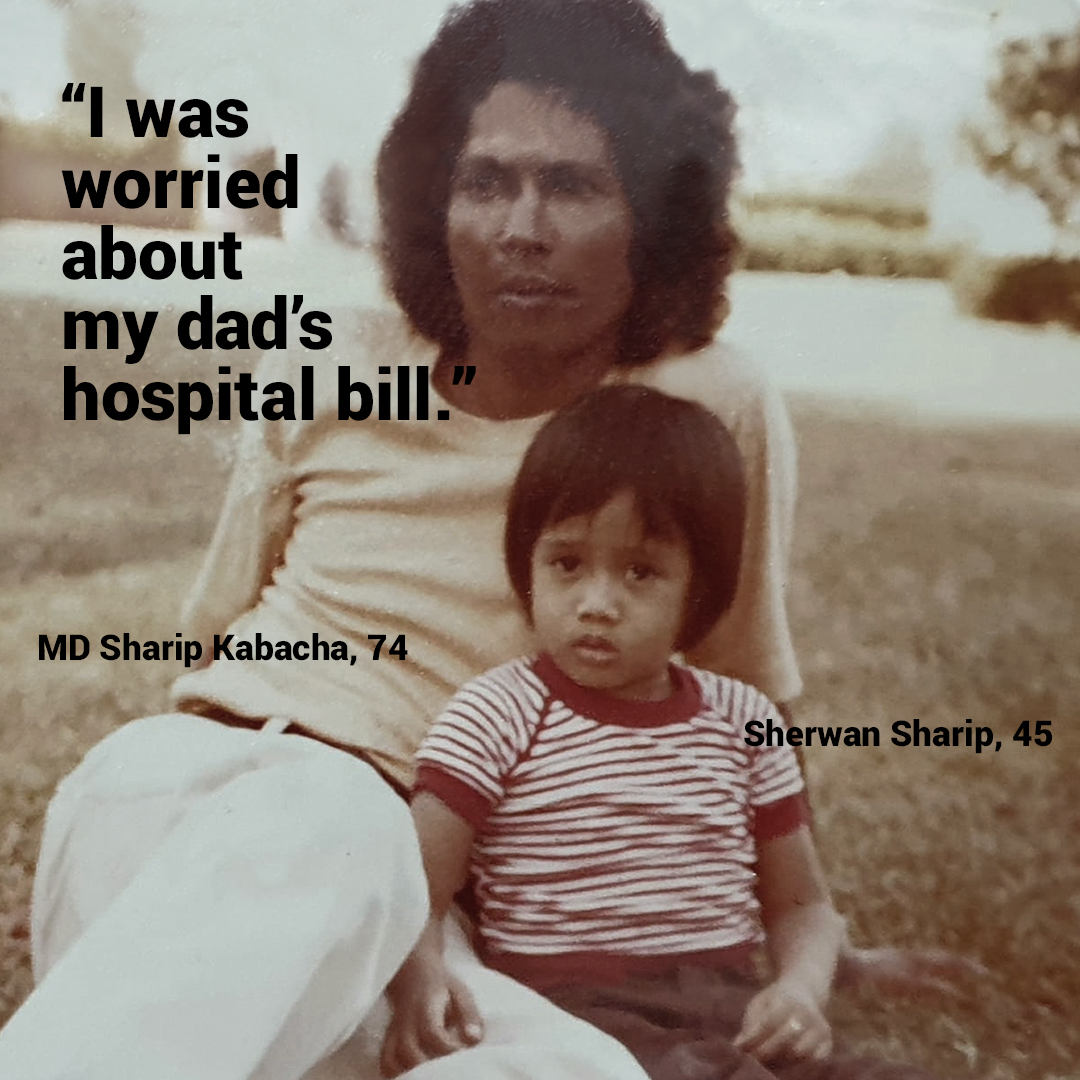

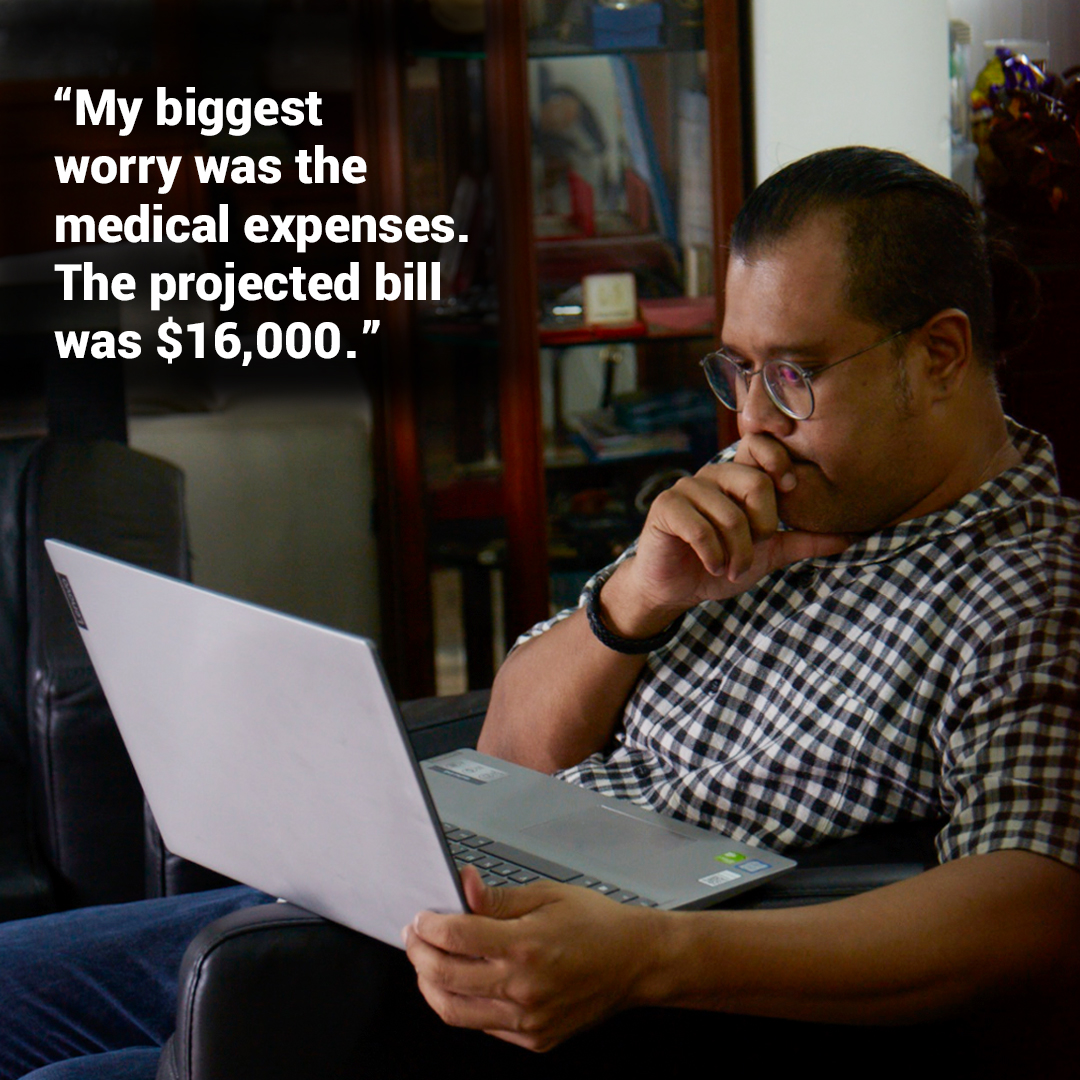

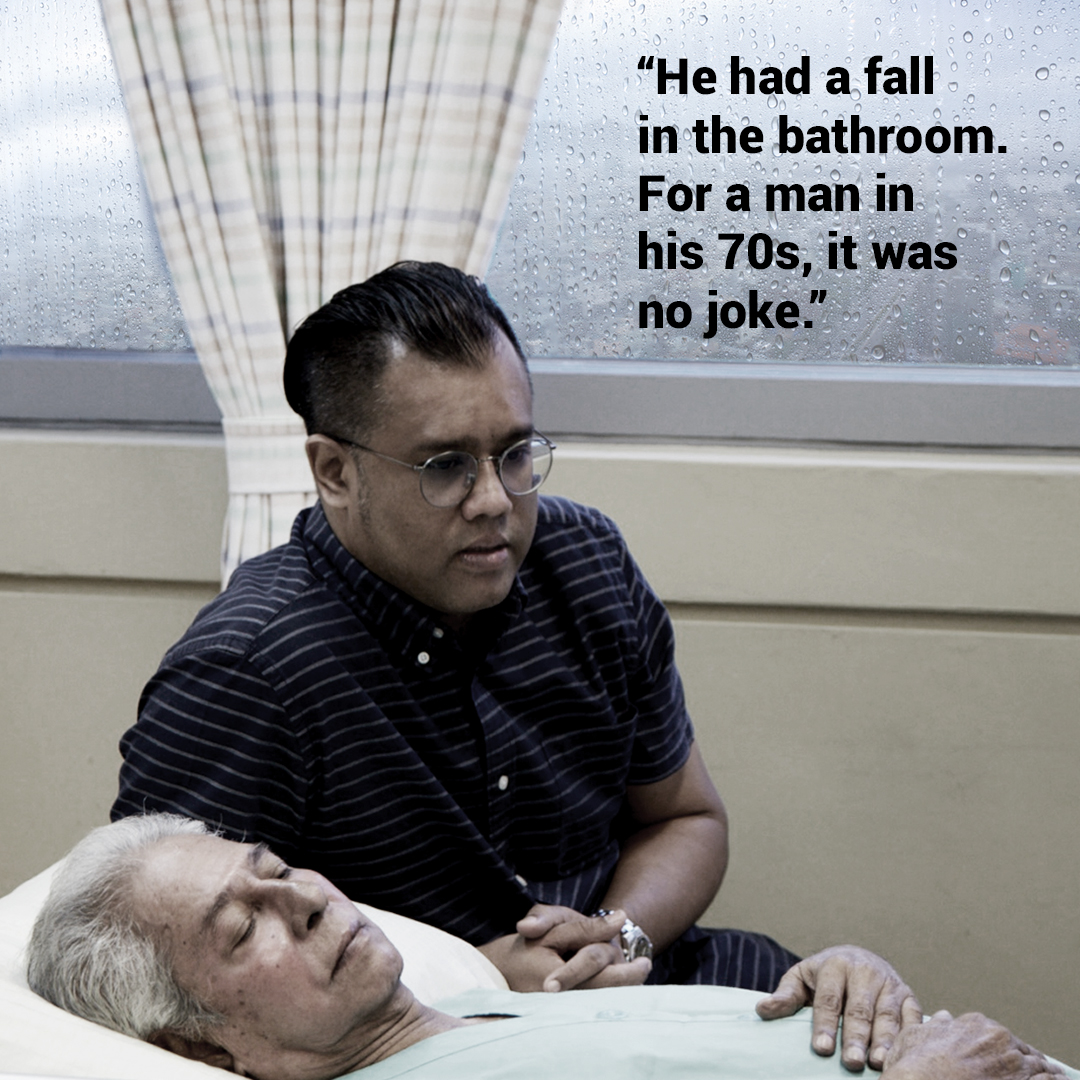

Click on for Sherwan's story on how subsidies, MediShield Life and MediSave helped his family with his father's hospital bills.

Found this useful? Check out our other articles about healthcare:

- Taking care of our seniors’ healthcare needs

- What’s the difference between the 3 types of CHAS cards?

- Quiz: How many hospitals and polyclinics do we have on this little sunny island?

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .