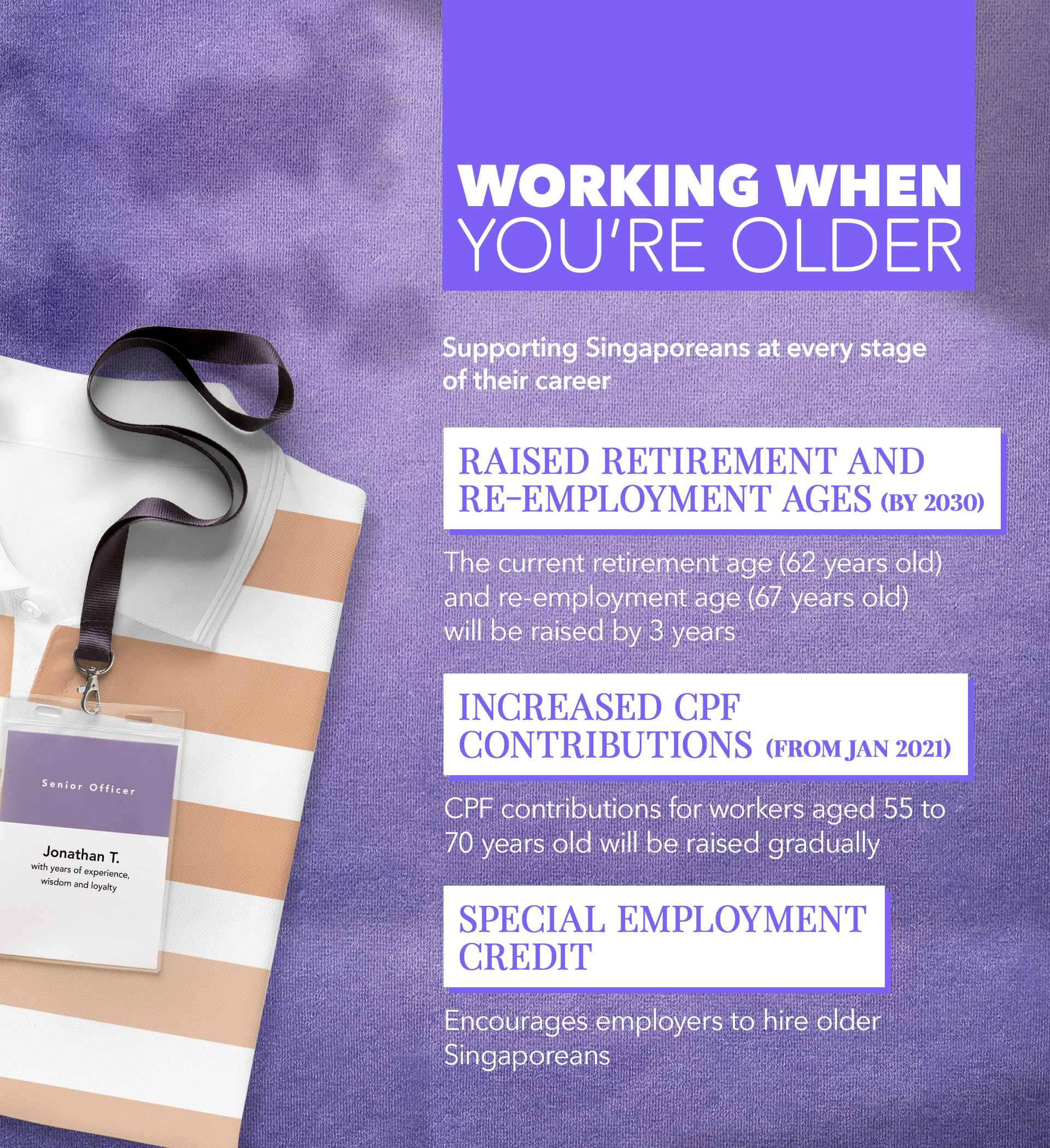

As we strive to keep pace with changes in technology, we must also expect the nature of the work that we do to change as we get older. If we think long-term, we can plan ahead and consider the types of roles that may be more suitable for us as we age. Given the increase in the minimum statutory Retirement and Re-employment Ages, those of us who wish to work longer have greater protections to do so.

Currently, your employer cannot dismiss you because of age if you are below 62. This is known as the minimum statutory Retirement Age, which will be raised to 63 from 1 Jul 2022, and gradually to 65 by 2030.Once you meet the minimum Retirement Age, your employer must offer you the opportunity to continue working as long as you are eligible for re-employment, up to the Re-employment Age. Today, the Re-employment Age is 67. This will be raised to 68 in from 1 Jul 2022, and gradually to 70 by 2030. Under re-employment, your employment terms – including responsibilities and roles – may be adjusted based on reasonable factors and subject to mutual agreement.

If your employer is unable to re-employ you, his re-employment obligations can be transferred to another employer with your agreement. If your employer is still unable to find a suitable job for you, you will be entitled to a one-off Employment Assistance Payment. This is meant to help you tide over the transition period while you seek alternative employment options.

Employers are also encouraged to engage you in structured career planning sessions when you are 45 years old and 55 years old. Conversations at age 45 can be centred on your future career plans and potential support from your company, while those conducted at age 55 can focus on the relevant skills needed for your re-employment.

Beyond job security, changes in the economic landscape have also raised more basic concerns about retirement adequacy. Our CPF scheme ensures that we have a source of income to turn to when we retire. To help us build up more retirement savings, the CPF contribution rates will be raised from 1 Jan 2021, with both you and your employer each increasing your contribution by up to 1%-point. In the longer term, the target CPF contribution rates are 37% for those aged 55 to 60, 26% for those aged 60 to 65, and 16.5% for those aged 65 to 70.

Encouraging employers to hire older Singaporeans – To further enhance the employability of older workers, the Special Employment Credit (SEC) was introduced in 2011 to encourage employers to hire older Singaporeans. Through the SEC, employers hiring Singaporean workers aged 55 and above earning up to $4,000 will receive wage offsets of up to 11% of an employee’s monthly wages. These schemes have been extended until end-2020.

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .