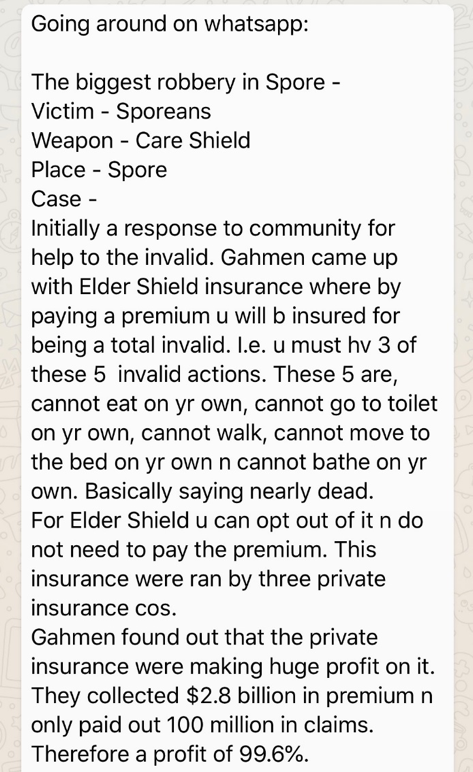

A misleading text message is being circulated on messaging platforms claiming that CareShield Life was introduced by the Government to reap profits off Singaporeans. It also suggests that the risk of severe disability is very low, making it unlikely for policyholders to make a claim.

This is what the message looks like:

The claims are untrue.

Claim: Schemes like ElderShield and CareShield Life were introduced to profit off Singaporeans, and the premiums collected become Government surpluses.

Fact: The Government will not profit from CareShield Life.

The premiums collected and returns from investments will stay within the fund so that policyholders can benefit through higher payouts or premium rebates.

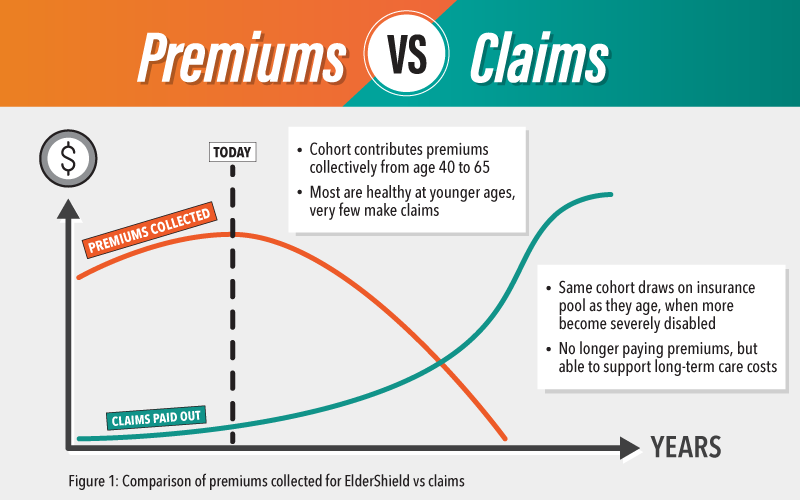

Today, premiums collected under ElderShield are more than the claims paid out, as most policyholders are relatively young. However, these premiums collected do not become Government surpluses. Rather, they are meant for future claims – when policyholders become older and more of them make claims for severe disabilities (see Figure 1 for a comparison of premiums collected versus claims).

*All CareShield Life premiums collected will remain within the fund meant for policyholders. It will not be transferred to other Government schemes.

Claim: The number of people who suffer from severe disability in old age is very few or close to none. Likewise, the number of claims.

Fact: As our population ages, one in two Singaporeans who is healthy at age 65 could become severely disabled in their lifetime.

This is backed by evidence. From 2013 to 2017, the annual claims paid out have risen more (up by 12%) than the annual premiums collected (up by 3%). This trend is expected to continue as more Singaporeans enter their silver years.

The duration of severe disability and the accompanying costs of long-term care will vary. Coupled with shrinking family sizes, it will be challenging to rely solely on personal and family savings to pay for one’s long-term care needs. While the expected median duration for severely disabled individuals to remain in disability is around 4 years, three in 10 severely disabled individuals are expected to remain in disability for 10 years or more.

* Schemes like ElderShield and the new CareShield Life will ensure that Singaporeans are protected against the variability in duration and the cost of long-term care needed. The Government will also provide subsidies to ensure that CareShield Life remains affordable for all Singaporeans.

Four ways how CareShield Life will provide better protection and assurance for Singaporeans’ long-term care:

- Lifetime cash payouts for as long as you are severely disabled.

- Payouts start at $600 per month in 2020, and will increase over time.

- Government subsidies will make CareShield Life more affordable. No one will lose coverage if they cannot pay the premiums.

- Premiums can be fully paid by Medisave.

More information on CareShield Life is available here.

This article is accurate as of June 2018. For updates, please refer to the Ministry of Health website at www.moh.gov.sg.

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .