What are digital tokens?

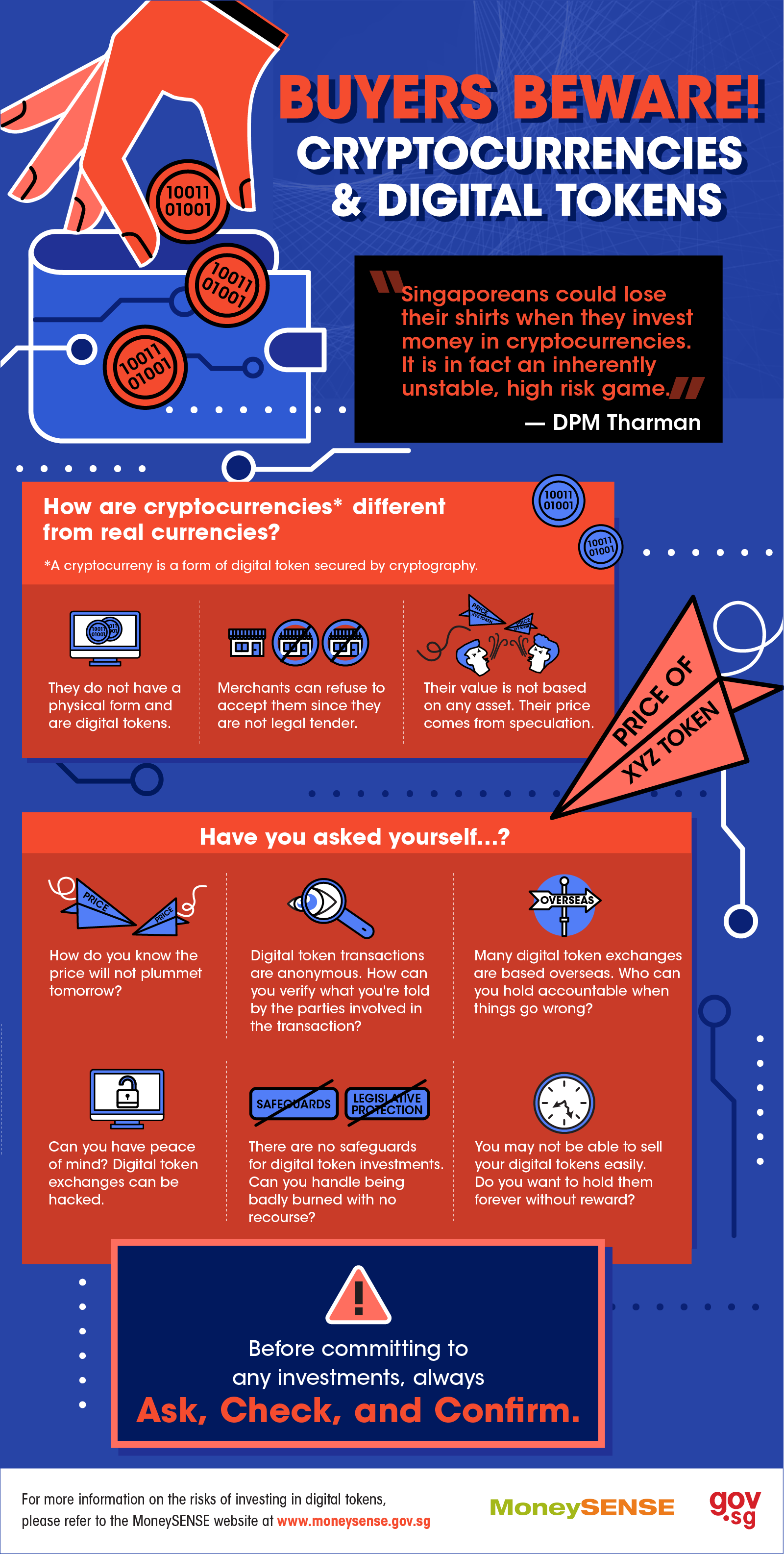

Digital tokens refer generally to a category of digitally-recorded instruments, which include digital payment tokens, or more commonly known as cryptocurrencies, and tokens issued through initial coin offerings. But some of these names are misleading. For example, cryptocurrencies are not actual currencies. You’ll never hold a digital token in your hand: digital tokens do not have a physical form unlike coins or notes. But that’s not the only trait of a real currency that digital tokens lack.

Because digital tokens aren’t issued by any government, they’re not legal tender. This means that consumers can only use digital tokens to pay merchants who are willing to accept them at whatever exchange value the merchants offer, as a mode of payment. Like most other jurisdictions, the Monetary Authority of Singapore currently does not regulate digital tokens.

Why do digital tokens seem so popular?

With thousands of digital tokens worldwide, including Bitcoin, Ether, and Litecoin, it seems like a whole new world of possibilities. Last year’s surging markets also led some people to think that digital tokens could make them money quickly and with little effort.

The hype is further boosted by digital token intermediaries who profit when people buy, sell, and exchange digital tokens through them. Because the value of any digital token is only as valuable as people deem it to be, speculators and digital token intermediaries have a vested interest in making the digital token bandwagon sound as attractive as possible.

What are digital tokens?

Digital tokens refer generally to a category of digitally-recorded instruments, which include digital payment tokens, or more commonly known as cryptocurrencies, and tokens issued through initial coin offerings. But some of these names are misleading. For example, cryptocurrencies are not actual currencies. You’ll never hold a digital token in your hand: digital tokens do not have a physical form unlike coins or notes. But that’s not the only trait of a real currency that digital tokens lack.

Because digital tokens aren’t issued by any government, they’re not legal tender. This means that consumers can only use digital tokens to pay merchants who are willing to accept them at whatever exchange value the merchants offer, as a mode of payment. Like most other jurisdictions, the Monetary Authority of Singapore currently does not regulate digital tokens.

Why do digital tokens seem so popular?

With thousands of digital tokens worldwide, including Bitcoin, Ether, and Litecoin, it seems like a whole new world of possibilities. Last year’s surging markets also led some people to think that digital tokens could make them money quickly and with little effort.

The hype is further boosted by digital token intermediaries who profit when people buy, sell, and exchange digital tokens through them. Because the value of any digital token is only as valuable as people deem it to be, speculators and digital token intermediaries have a vested interest in making the digital token bandwagon sound as attractive as possible.

Are digital tokens regulated?

No, digital tokens are not regulated because they are not issued by the Singapore government and are not legal tender. There is no legislative protection for those who lose money from investing in digital tokens.

However, this doesn’t mean that the Government isn’t taking steps to ensure that digital tokens are not used as tools for fraud or other crimes. Under the proposed Payment Services Bill, the Monetary Authority of Singapore will be imposing Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) requirements on digital token intermediaries.

Is it true you can definitely make money from investing in digital tokens?

Money doesn’t grow on trees, and investments are never a sure-win. Digital token investments, in particular, are an extremely high-risk, speculative instrument.

Digital tokens are not backed by any assets or issuer, which means that no one bears any legal responsibility for the money you put into digital tokens. Simply put, you are making an investment with a party that cannot be held accountable. It is as good as taking a gamble.

Very few merchants accept digital tokens as payment, making them far less functional than actual currencies.

What are the risks of investing in digital tokens?

There are four serious aspects of digital tokens which make them highly risky: their speculative nature, their lack of transparency, their exposure to hackers and fraud, and their insufficient secondary market liquidity.

Speculative Nature

What’s the value of digital tokens actually based on?

Digital tokens are highly speculative instruments whose value is not underpinned by any asset, or backed by any issuer. They are generated by computer code, running on decentralized networks, powered by blockchain technology which remains challenging for most people to thoroughly understand.

As DPM Tharman pointed out, digital tokens investments are “in fact an inherently unstable, high risk game…subject to sharp swings in prices driven by speculation.” Should worst comes to worst, a digital token’s price could plummet to zero, be rendered worthless, and leave investors with none of their capital.

Furthermore, there is little information to help investors gauge their value. Many don’t know enough to fully comprehend digital tokens, much less conduct their own research to verify what they are told.

Lack of transparency

Can I put my trust in digital token transactions?

Digital tokens are mainly traded on opaque markets, with zero regulatory protection for investors. Digital token transactions are generally anonymous, which make them easily misused for unlawful activities. If a digital token intermediary has been found using digital tokens illegally, their operations can be shut down by law enforcement agencies. When that happens, investors who have transacted with such an intermediary could lose all their money.

Can I make digital token transactions with peace of mind?

When dealing with digital token intermediaries, you Even if digital token platforms don’t collapse, they might still be taken down by malicious actors. Digital token intermediaries may not be sufficiently robust against hackers. For example, after South Korean cryptocurrency exchange Youbit was hacked for a second time, it had to file for bankruptcy in December 2017.

could be exposed to a greater risk of fraud and massive losses. Most digital token intermediaries don’t have a presence in Singapore, making it even harder to verify their credibility or authenticity. If the platform collapses, it’ll be difficult to trace the platform’s operators.

Exposure to hackers and fraud, insufficient secondary market liquidity

What else could jeopardize my digital token investment?

Your digital tokens are stored in a digital wallet. Similar to digital token intermediaries, the digital wallet could be hacked. You could lose all your digital tokens as a result.

On top of that, fraud has already occurred with companies that claim to offer digital token-related products and services. Initial coin offerings disguised as Ponzi schemes are not uncommon. Platforms like OneCoin and BitConnect have been shut down for their pyramid schemes, with BitConnect’s price crashing from $452 to $9.

Other fraud cases see pump-and-dump maneuvers, where the price of a digital token is artificially inflated by insiders through false and misleading exaggerations. When the price reaches a feverish peak, these insiders then cash out en masse, all at once, leading to a price collapse.

Finally, there is also the risk that you may not be able to exit your digital token investment easily. There may not be enough active buyers and sellers in the secondary market for digital tokens. You might never get the chance to cash out and liquidate your investment.

What should I do before making any investment decisions?

Do your homework – make sure you fully understand the benefits and risks of the product or service.

Make a thorough assessment on whether the features of the product or service are suitable to your needs.

Before finally committing to an investment, you should ask, check and confirm.

Ask as many questions as you need to fully understand the investment.

Check and double-check if the information provided to you (e.g. company’s track records, owners and directors’ experience and qualifications) is actually true, and whether there are any complaints or negative comments made about the investment opportunity (whether in the news or on online forums.

Confirm the legitimacy of the seller or its representative’s credentials with external resources such as:

For more information on the risks of investing in digital tokens, please refer to the MoneySENSE website.

RELATED ARTICLES

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .