The Government has introduced various initiatives to support Singaporeans during the COVID-19 pandemic.

Wondering what you stand to benefit from?

Check out our list of schemes that may help you stay safe, pay for necessities, and upgrade your skills.

1. GET UTILITY REBATES

Eligible HDB households will receive the next instalment of the GST Voucher U-Save rebates in October.

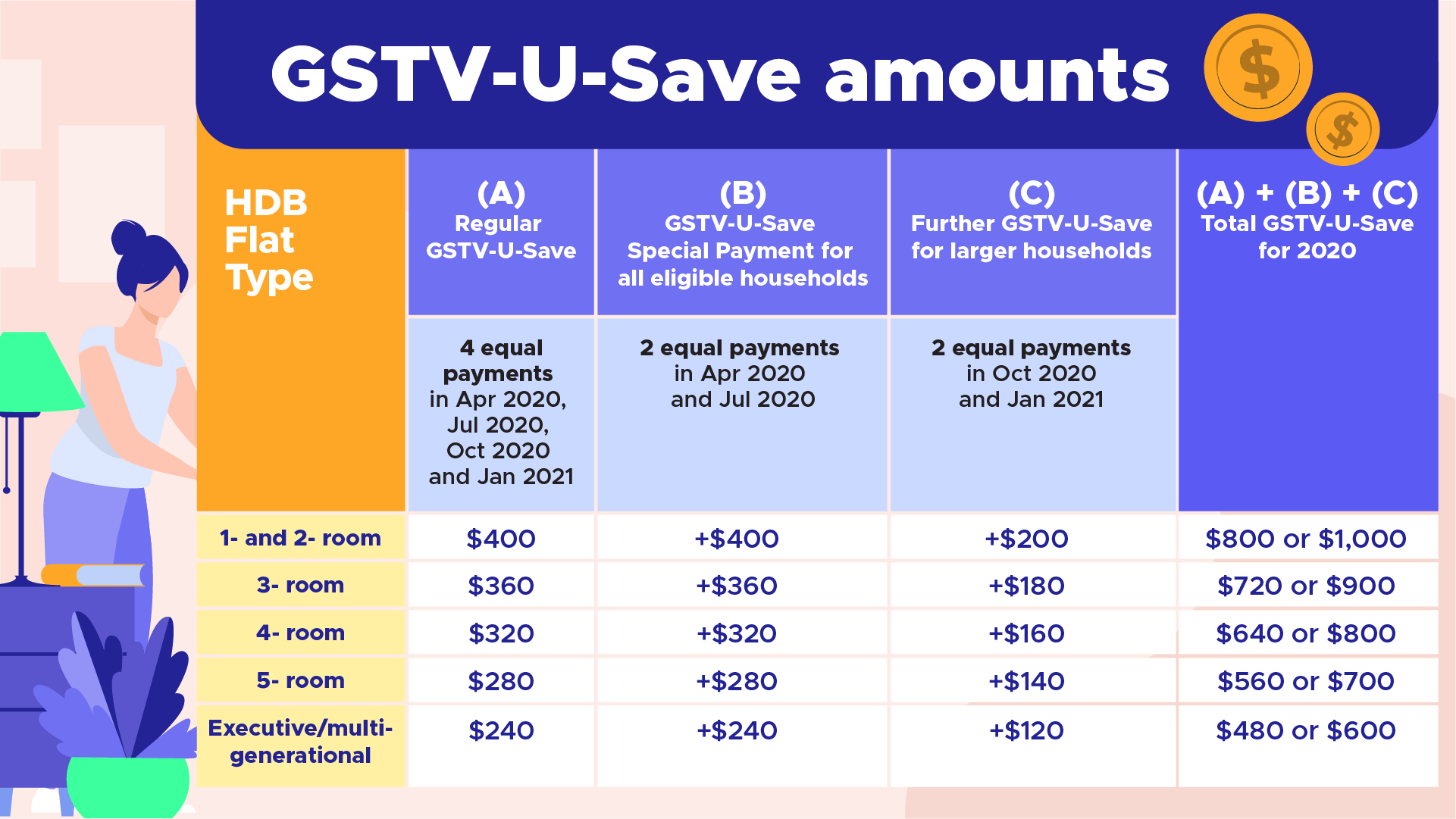

This is the third of four regular payments to help Singaporeans with their household utilities bills. Previous rebates were paid out in April and July this year. Each household stands to get between $240 and $400, depending on the flat-type.

In addition, households with five or more members will receive further GSTV-U-Save rebates of between $120 and $200 per household, as part of the Government’s Care and Support Package. The first of two equal payments will also be made in October 2020.

| Who benefits? All HDB households with more than one Singaporean occupant, where immediate family members living in the same flat do not own or have interest in more than one property, are eligible for both the GSTV-U-Save (A) and the GSTV-U-Save Special Payment (B). Larger households with five or more members will be eligible for the further GSTV-U-Save Rebate (C). How to collect? Rebates will be credited directly to the HDB flat’s utilities account Find out more: visit go.gov.sg/gstusave |

2. RECEIVE GROCERY VOUCHERS

To help households with their expenses, about 150,000 Singaporeans living in 1- and 2-room HDB flats will receive $150 worth of grocery vouchers in October 2020.

Come December 2020, recipients will also get another $150 worth of grocery vouchers, followed by a further $100 worth of vouchers in October 2021.

The vouchers may be used at FairPrice, Giant, Prime and Sheng Siong supermarkets.

| Who benefits? All Singaporeans aged 21 and above, living in 1- and 2- room HDB flats, owning not more than one property How to collect? Vouchers will be delivered to the NRIC-registered addresses of eligible citizens via mail in October and December 2020 Find out more: visit go.gov.sg/groceryvouchersfaq2020 |

3. REDISCOVER SINGAPORE

Can’t travel overseas, don’t worry!

There’s lots to see and do in Singapore, and all Singaporeans aged 18 and above will be receiving $100 in digital SingapoRediscovers vouchers in December 2020 to rediscover Singapore.

The vouchers aim to support our tourism businesses, which have been among the hardest hit by the COVID-19 pandemic. Issued in denominations of $10, the vouchers can be used for hotel stays, attractions and/or tours.

| Who benefits? All Singaporeans aged 18 and above How to collect? Digital vouchers will be available via SingPass from December 2020 Find out more: visit go.gov.sg/singaporediscovers |

4. UPSKILL WITH YOUR SKILLSFUTURE CREDITS

If you’re clearing your year-end leave, why not make some time to learn new skills?

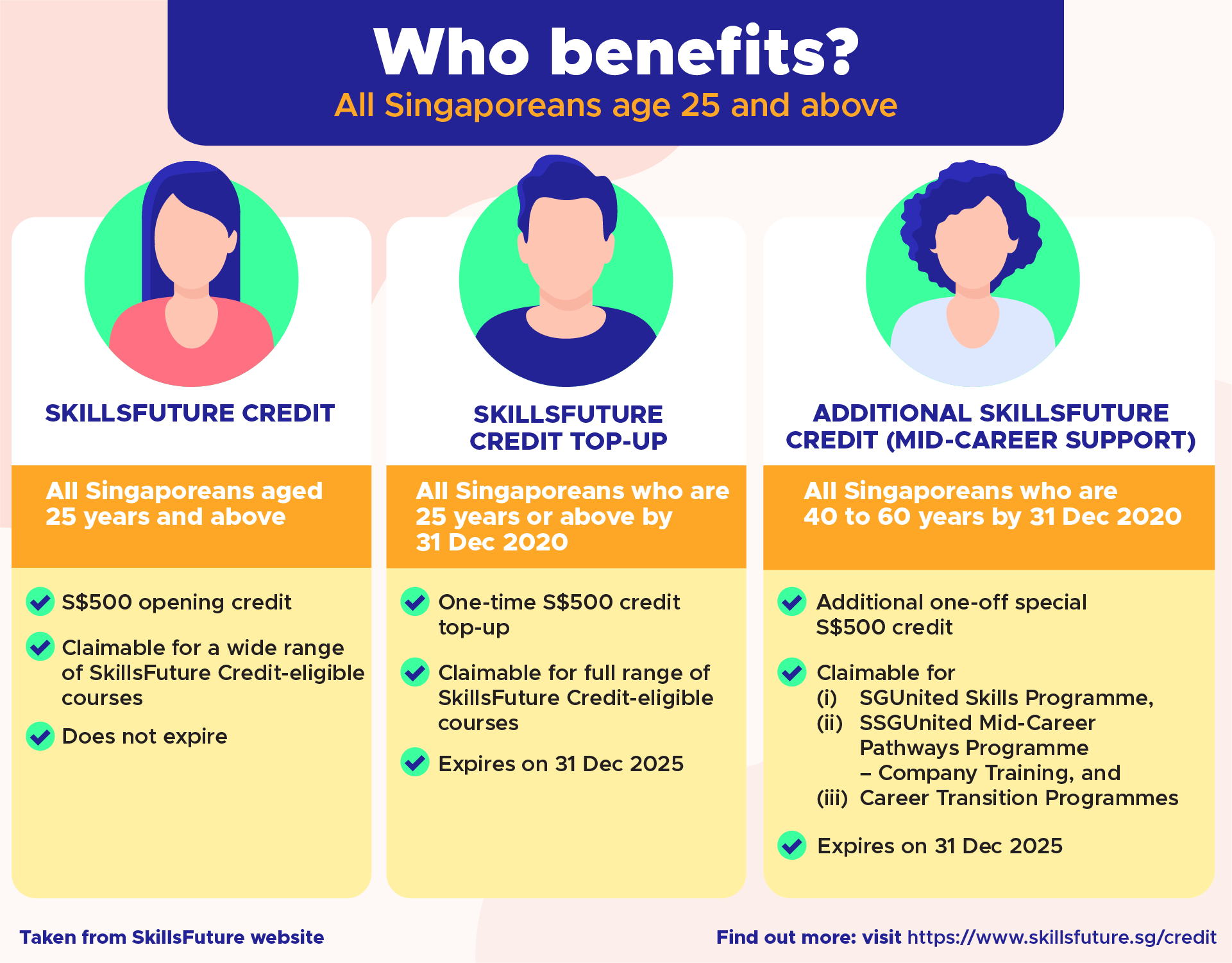

From October 2020, eligible Singaporeans will be able to access an additional $500 top-up in SkillsFuture credit (expiring 31 December 2025) on top of their existing account balance.

Mid-career individuals aged 40-60 years old (as of 31 December 2020) will also have an additional top-up of $500 SkillsFuture credits, to improve their access to career transition programmes.

| Who benefits? All Singaporeans age 25 and above  Find out more: visit go.gov.sg/skillsfuturecredit2020 |

5. CASH PAYOUTS FOR LOWER-INCOME WORKERS

Eligible lower-income workers will receive a Workfare Special Payment payout of $3,000, under the Government’s Care and Support Package. Paid over two equal payments of $1,500 each in July and October 2020, the scheme has also been extended to include some individuals that did not qualify previously.

| Who benefits? Singaporeans will qualify for the WSP in WY2020 if they are: • Aged 35 and above; and • Earn a gross monthly income1 of not more than $2,300 for the month worked (more details here) 1 Inclusive of basic salary and extra wages such as overtime and bonuses 2 The individual must also earn an average gross monthly income of not more than $2,300 in the past 12 months How to collect? Payouts will be credited directly to the individuals bank account, or through cheques sent to the NRIC addresses for those who do not have a bank account registered for cash payments from the Government. Payments by cheque might take up to 2 weeks longer compared to bank crediting Find out more: visit go.gov.sg/cpfwsp2020 |

RELATED ARTICLES

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .