1. The article, Facebook post, X (formerly known as “Twitter”) post and LinkedIn post published on 21 August 2023 by Mr Kenneth Jeyaretnam contain false statements of fact.

False statements of fact

2. Mr Jeyaretnam has made several false statements.

Majulah Package, Pioneer Generation Package, and Merdeka Generation Package disbursements

3. The article states that the Government does not expect to fully disburse to the intended beneficiaries the moneys set aside for funds to support the Majulah Package, the Pioneer Generation Package, and the Merdeka Generation Package disbursements. This is untrue.

- The Government has set aside moneys for funds to support the Majulah Package, the Pioneer Generation Package, and the Merdeka Generation Package (collectively, “the Packages”) in order to fund specific disbursements as regards the Packages. The Government projects and has always remained committed to the full disbursement of the moneys in the funds towards the Packages.

- The moneys for the funds are to meet the important long-term spending commitment towards the Packages, so that the Packages will be funded without burdening future generations.

- The moneys set aside therefore entail real spending to support the Packages.

Manpower statistics

4. The article stated that as long as a person is a full-time student, that person will be considered employed in Singapore’s manpower statistics. This is false.

- Not every full-time student is, by default, regarded as “employed” in Singapore’s manpower statistics. Whether a full-time student is considered to be employed depends on whether the person is working while studying.

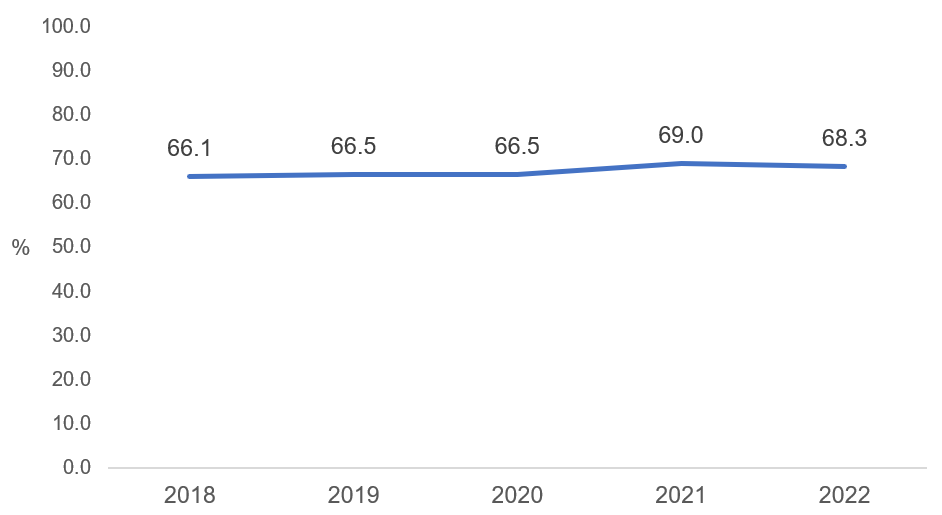

5. The article stated that the recent Labour Force Participation Rate for Singapore citizens is a low figure at below 50%. This is false.

- The Ministry of Manpower (MOM)’s Comprehensive Labour Force Survey shows that the Labour Force Participation Rate1 for Singapore citizens over the past five years has consistently stayed well above 50%. In 2022, it was 68.3%.

Chart 1: Labour Force Participation Rate among Singapore citizens

Source: Comprehensive Labour Force Survey, 2018 – 2022, Manpower Research & Statistics Department, MOM

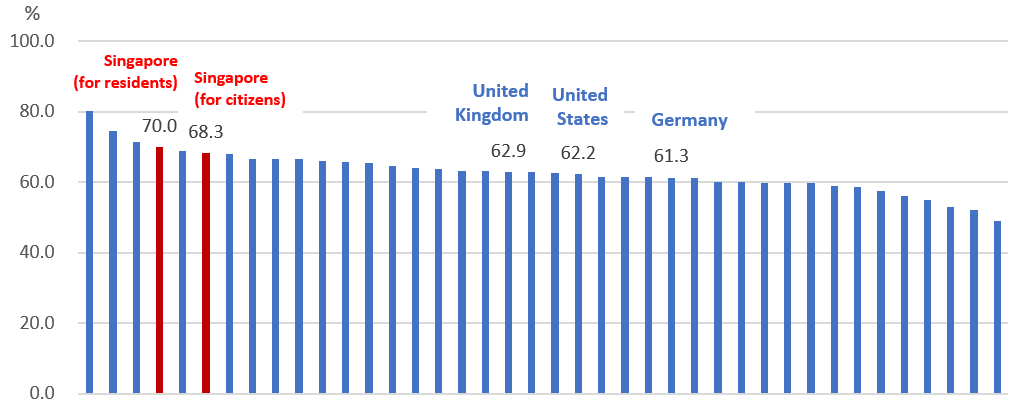

- Singapore’s Labour Force Participation Rate (68.3% for Singapore citizens and 70% for residents in 2022) is very high compared to the Organization for Economic Cooperation and Development (OECD) countries. By way of comparison, the 2022 Labour Force Participation Rate is 62.9% in the United Kingdom, 62.2% in the United States and 61.3% in Germany.

Chart 2: Labour Force Participation Rate (%) in Singapore and in OECD countries, 2022

Note: The Labour Force Participation Rates for residents and citizens in Singapore are extracted from MOM’s statistics. For the OECD countries, the data are extracted from https://data.oecd.org/emp/labour-force-participation-rate.htm.

- The MOM does not usually break down resident labour force statistics into statistics for Singapore citizens and permanent residents. This is because Singapore citizens make up a large majority of the resident labour force, at about 85%. The permanent resident population has also remained stable over time. These two facts taken together mean that for the most part, resident data mirrors citizen data, and having citizen data in addition to resident data provides little additional information. For Singapore, the Labour Force Participation Rate for residents (at 70.0%) is also close to the rate for citizens (at 68.3%). Please visit https://stats.mom.gov.sg/Pages/Labour-Force-In-Singapore-2022.aspx for more information on our labour force.

Ridout Road

6. Mr Jeyaretnam continues to issue false statements relating to the rental of properties from the Singapore Land Authority (SLA). He seeks to mislead the public despite some of his falsehoods having been clarified and debunked after the investigation by the Corrupt Practices Investigation Bureau (CPIB) and statements in Parliament.

7. In his article and posts, Mr Jeyaretnam makes the statement that SLA rented out 26 and 31 Ridout Road at the rentals it did, because Minister K Shanmugam and Minister Vivian Balakrishnan were going to be its tenants and Minister Shanmugam controlled SLA. This is untrue.

8. He made a similar false statement of fact in an earlier publication that has already been clarified: see https://www.gov.sg/article/factually020823.

9. The rentals for both 26 and 31 Ridout Road were based on market value. Details on how the market value was arrived at have been given in Parliament. The two properties were also vacant for some years, before they were rented out to the two Ministers. It was also stated in Parliament that Minister Shanmugam had recused himself, in respect of his rental transaction.

10. Mr Jeyaretnam’s article and posts also make the statement that the Government uses the principle of market value to value land for sale to the public, but it did not do so for renting out the land that was part of the 26 Ridout Road property. This is untrue.

11. The underlying principle used by the Government for determining the value of land for sale to the public and land for rental (including rental of the land that was part of the 26 Ridout Road property) is the same – it is to transact at fair market value. Whether for short-term rental or a longer-term sale, the valuation seeks to establish the price that the market is willing to pay in each case, so that the Government transacts at fair market value.

12. Next, the article, Facebook, X and LinkedIn posts make the statement that SLA allowed Minister Shanmugam to annex additional land to the property he rented. This is untrue. The facts were made clear in Parliament.

13. Finally, the article, Facebook, X and LinkedIn posts make the statement that Senior Minister Teo said in Parliament that the additional cleared land of 26 Ridout Road was virtually valueless. This is untrue.

14. Senior Minister Teo made no such statement in Parliament. He had explained at length that the Guide Rent was assessed by professional valuers. He had also referred to Minister Edwin Tong’s explanation on how market value was arrived at.

Money laundering and foreign tax evasion

15. Mr Kenneth Jeyaretnam falsely stated that the Government deliberately does not take action against money laundering and foreign tax evasion, allowing huge inflows of “dirty money” into Singapore. This is untrue. Where an offence is disclosed and the Government has sufficient basis to act, it does so. The Government has in place policies and a robust and comprehensive regulatory framework to counter money laundering, which are tightly supervised and enforced.

a. Financial institutions and other designated entities are required to implement anti-money laundering measures, such as customer due diligence checks.

b. Suspicious transaction reports are also analysed by the Suspicious Transaction Reporting Office, to detect money laundering and other serious crimes. Where possible offences are detected, the financial intelligence is disseminated to relevant enforcement and regulatory agencies for follow-up. Recently, extensive investigations and follow-up from intelligence, including the analysis of Suspicious Transaction Reports, contributed to an island-wide anti-money laundering operation by the Police on 15 August 2023. This operation resulted in the arrest of 10 foreign nationals and about $1bn in cash and assets being seized, frozen or issued with prohibition of disposal orders.

c. The Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 (“CDSA”) was amended over the years, with the latest amendments being passed by Parliament in 2023, to strengthen our ability to enforce against and prosecute offences relating to money laundering and tax evasion. The CDSA provides for the confiscation of benefits derived from a wide range of criminal conduct, including foreign tax evasion offences.

16. The Minister for Culture, Community and Youth and Second Minister for Law, Edwin Tong, has instructed the Protection from Online Falsehoods and Manipulation Act Office to issue a Correction Direction to Mr Kenneth Jeyaretnamin respect of his article, Facebook post, X post and LinkedIn post.

Additional clarifications

GST Voucher Fund disbursements

17. The top-ups to the GST Voucher (GSTV) Fund demonstrate the Government’s commitment to set aside additional resources to flow higher levels of support to Singaporeans during this period of higher inflation, and to cushion the impact of the new GST rates.

18. The GSTV Fund funds both the Assurance Package (AP) and the permanent GSTV scheme. The AP runs from FY2022 to FY2026. The GSTV scheme is a permanent scheme that has been running since 2012. Singaporeans have already been receiving both types of payouts. Further enhancements to both the AP and permanent GSTV scheme were made in Budget 2023. The Government expects to disburse the bulk of the funds in the GSTV Fund (balance of $9.3 billion as at 31 March 2023) over the next five years.

Reserves

19. The Government is committed to meeting the needs of Singaporeans. The reserves support Singapore’s current spending needs through its contribution to the annual Budget. About one-fifth of Government spending is funded by the investment returns of our reserves through the Net Investment Returns Contribution (NIRC), and the NIRC has provided an annual revenue stream of about 3.5% of GDP on average over the past 5 years. For the financial year which ended on 31 March 2023, the NIRC was about $22.4 billion.

20. The reserves also serve as our crisis fund. During the Global Financial Crisis and across FY2020 to FY2022 in our fight against COVID-19, our reserves helped us to weather crises without having to incur debt that will have to be borne by future generations. The total draw on past reserves for COVID-19 response measures across FY2020 to FY2022 was about $40 billion. By tapping on the reserves, the Government was able to fund public health measures as well as economic and social support measures, in order to save lives and protect livelihoods.

Government support for unemployed workers

21. The article also stated that the Government’s financial support for unemployed workers announced by the Prime Minister at the National Day Rally 2023 is not intended to help them find jobs but to keep them from being counted as unemployed. This is untrue.

- The Prime Minister had stated at the National Day Rally 2023 that the aim of the Government’s financial support for workers who lose their jobs is to “ease the immediate pressure that jobseekers experience so they can focus on upgrading their skills for a better long-term job”.

- As with any other Government support for training or reskilling, the Government’s objective is to improve workers’ skills and employability which would translate to better employment outcomes for them. For example, about 9 in 10 individuals placed through Workforce Singapore's Career Conversion Programmes remained employed 24 months after placement. In addition, about 6 in 10 individuals who went through SkillsFuture Singapore’s train-and-place programmes during the pandemic found employment within 6 months of completing the training.

Pricing of BTO flats

22. HDB does not price BTO flats for cost recovery. HDB’s flat pricing approach is totally separate and independent from the BTO projects’ development costs.

23. Instead, BTO flats are priced with generous subsidies such that they remain affordable to Singaporeans across different income levels. The difference in prices between the comparable resale flats and subsidised BTO flats broadly reflects the subsidies provided for BTO flats, after accounting for differences in attributes and tenure.

HDB flat sizes

24. HDB flats are designed to provide a living environment that is functional and comfortable. HDB flat sizes have not changed since 1997, but average household sizes have decreased.

25. Members of the public are advised not to speculate and/or spread unverified rumours.

1Labour Force Participation Rate of Singapore citizens is defined as the number of Singapore citizens aged 15 years and over who are either employed (i.e. working) or unemployed (i.e. not working but actively looking for a job and available for work), as a percentage of the total number of Singapore citizens aged 15 and over, during the reference period. This definition accords with international convention.

Related Article

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .