Factually summarises what you need to know.

1. There is no change to the Payout Eligibility Age – it is 65

The Payout Eligibility Age, which is 65 years old, is the age that you can start receiving your retirement payouts.

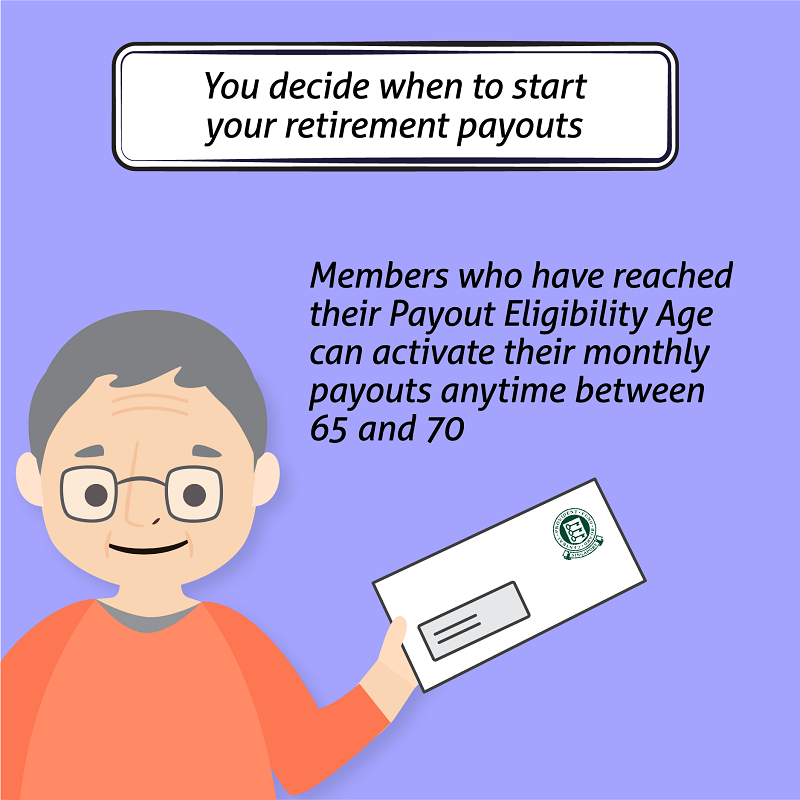

2. You decide when you start your payouts

Each CPF member, not the CPF Board, decides when to start his/her own retirement payouts. This has always been the case.

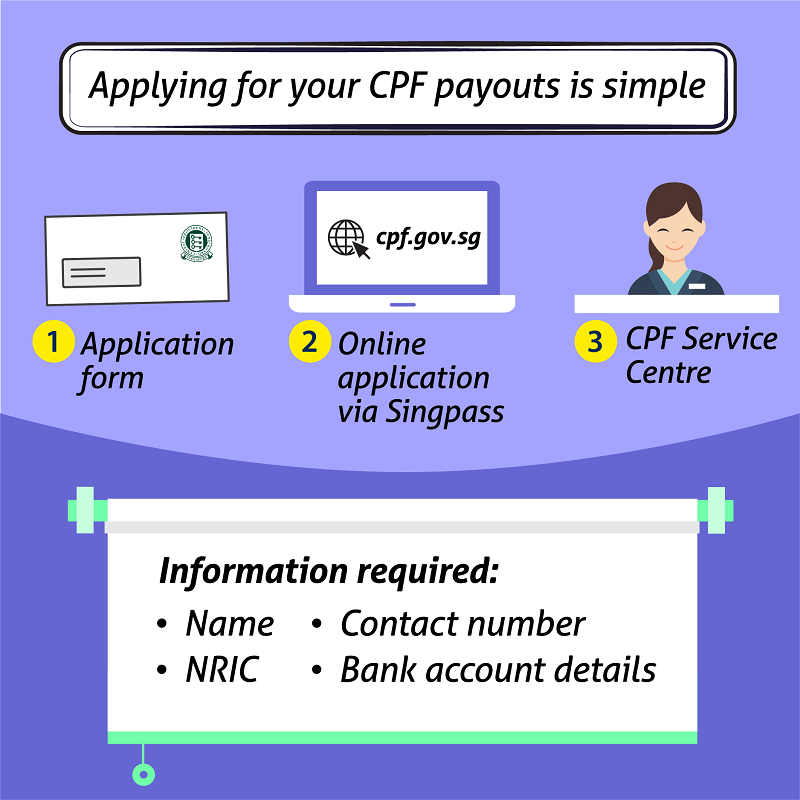

3. Starting your CPF payouts is simple

About six months before they turn 65, CPF members will receive a letter from the CPF Board. It includes an application form to start payouts. They only need to fill in basic information - name, NRIC, contact and bank account details - and mail the completed form to the CPF Board.

They can also start their payouts by making an application online on the CPF website or at a CPF Service Centre.

For members who do not apply, CPF Board will continue to remind them in their CPF Yearly Statement of Account.

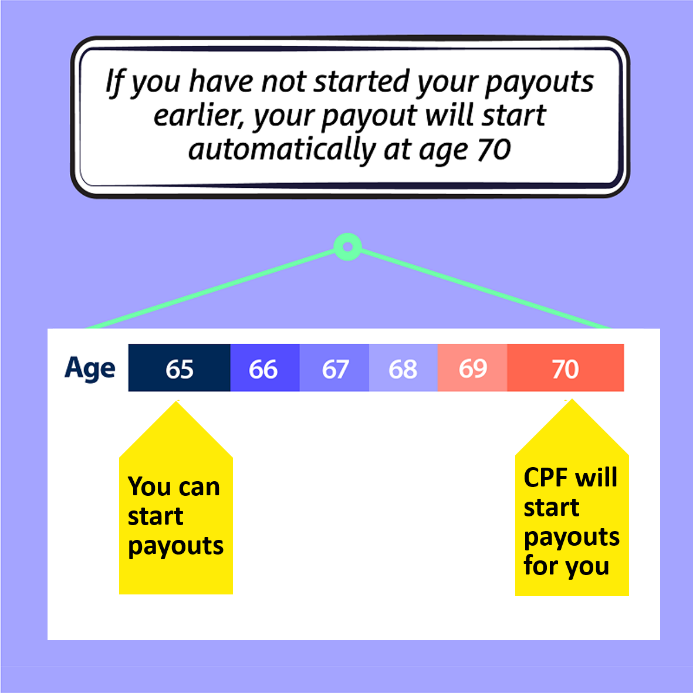

4. CPF Board will start payouts if you don’t do so by age 70

In the past, some CPF members did not submit their applications to start their payouts. This resulted in their savings staying in their accounts until they passed away.

To help CPF members enjoy a stream of income in retirement, CPF Board automatically starts their payouts at age 70 if they have not applied to do so by then..

5. You will get more, if you start your payouts later

CPF members can start their payouts anytime between age 65 and 70.

We use cookies to tailor your browsing experience. By continuing to use Gov.sg, you accept our use of cookies. To decline cookies at any time, you may adjust your browser settings. Find out more about your cookie preferences here .